At DUAL, our commitment lies in educating and improving the comprehension of Statutory Liability cover for both brokers and clients.

DUAL's Statutory Liability policy provides cover for a fine ordered against the Insured following conviction of an offence, along with cover for the Insured's defence costs (including in respect of an official investigation involving the Insured).

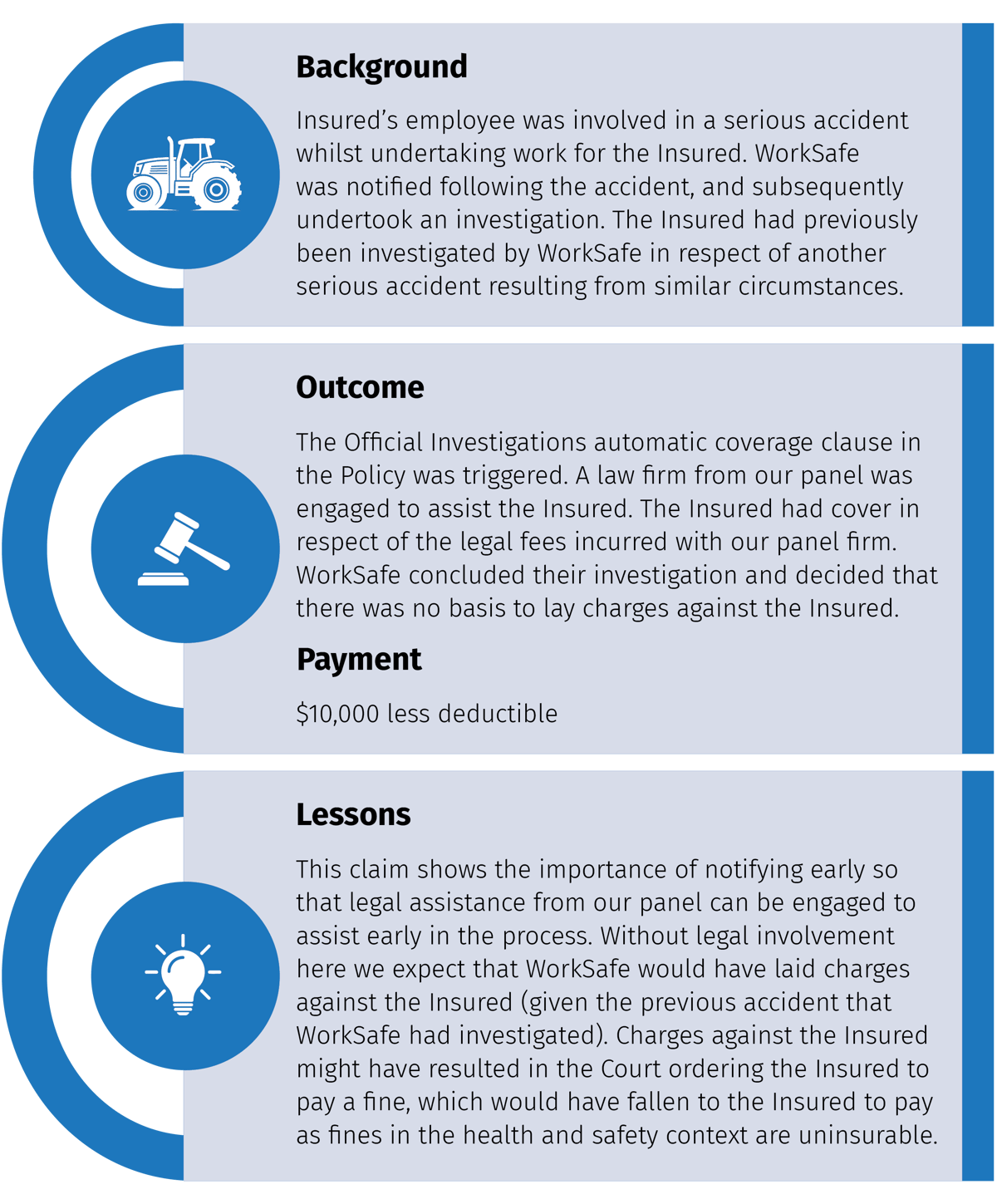

Below is a recent DUAL Statutory Liability claims scenario we wanted to share which illustrates the importance of having this cover in place.

This case involved a farming and planting contractor whose employee was injured in a serious accident while working. The incident prompted a WorkSafe investigation. Fortunately, the Official Investigations automatic coverage clause in the policy was activated, providing legal assistance from a panel law firm. Despite the severity of the incident, WorkSafe ultimately decided not to press charges against the Insured. This claims scenario highlights the importance of early notification so that legal assistance from our panel can mitigate the potential outcome for the Insured.

If you have any questions regarding our Statutory Liability offering, please don't hesitate to reach out or click HERE to view our Product Profile.